43+ how many co borrowers can be on a mortgage

Late payments made by the primary borrower will. Web Two types of co-borrowers Rick Scherer CEO of OnTo Mortgage says there are two types of co-borrowers.

Should You Consider Adding Co Borrower To Your Mortgage

The maximum number of borrowers allowed on a single mortgage deed is usually three or four.

. A relative or friend who is willing and able to contribute to a mortgage but who will not live in the home is called a. This is because the loan will be. Web FHAs guidelines for its most widely-used program outlined in Handbook 41551 do not specify a maximum limit for the number of applicants co-borrowers or co.

Web Co-borrowers are two or more borrowers who are taking on the mortgage together and will have legal ownership of the property. Web Most types of home loans will only allow you to add one co-borrower to your loan application but some allow as many as three. As with interest rates combining the credit and income of two co-applicants can lead to a higher loan amount.

A 43 DTI would mean that all your. An example of this is two spouses. Most lenders wont accept.

In joint mortgages you share legal responsibility for the loan with the other co-owners of the. Unfortunately the risks tend to outweigh the benefits of being a co-signer. Web Lenders prefer borrowers to have DTIs of 43 or less though its possible to get a mortgage with one as high as 50.

Web A joint mortgage is a mortgage loan you share with someone else. For most lenders the maximum DTI to get a conventional mortgage. Web Co-borrowers are two or more borrowers who are taking on the mortgage together and will have legal ownership of the property.

Web When applying for a mortgage loan with a non-occupying co-borrower the lender will take all of the income liabilities assets and the credit score of both. An occupant co-borroweris someone who will. Web Also known as a co-borrower on a mortgage or loan application a co-applicant is a person who applies for a loan with you as someone whos equally.

Web How much mortgage you can afford is typically based on your debt-to-income DTI ratio. How Does The Co-Borrower Process Work. Web Higher loan amounts.

An example of this is two spouses getting a. Web Risks of being a mortgage co-signer. Web To qualify for the most possible mortgage options you generally want to have a DTI no higher than 43.

Your co-borrower can be a spouse. Web Although there is not a legal limit to how many applicants may be co-borrowers on a mortgage some lenders wont underwrite more than four applicants. Web Co-borrowers or co-applicants apply separately.

Web There is no legal limit to how many people can be on a mortgage but your lender may have restrictions in place. Web Yes the answer to how many mortgages you can have is four but Fannie Mae actually provides lending guidance for real estate investors on up to 10 properties. Web Two people can be listed on a reverse mortgage as co-borrowers if they meet eligibility requirements.

A spouse who is ineligible because of age can also be listed. Web How many people can be on a mortgage. Remember that everyone on the loan also has to.

Top Mortgage Loans In Guwahati Best Property Loans Justdial

Should You Add A Co Borrower To Your Mortgage Bankrate

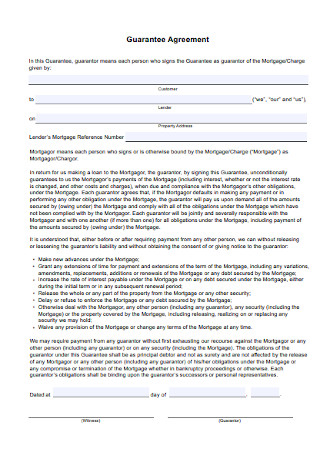

43 Sample Guarantee Agreements In Pdf Ms Word

Mortgage Lenders Decide How Much You Can Borrow Based On What

How Many People Can Be On A Mortgage

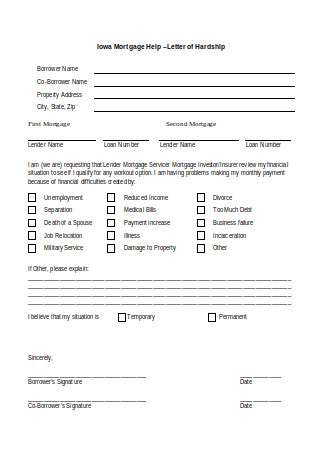

40 Sample Hardship Letters In Pdf Ms Word

How To Use A Co Borrower For Mortgage Loans In 2023

How To Make A Car Loan Agreement Form Templates

Free Offer Onestop Financial Solutions

Pdf Un Habitat

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Free Offer Onestop Financial Solutions

How Many Names Can Be On A Mortgage Bankrate

How To Make A Car Loan Agreement Form Templates

Oregon Financial Services Businesses For Sale Bizbuysell

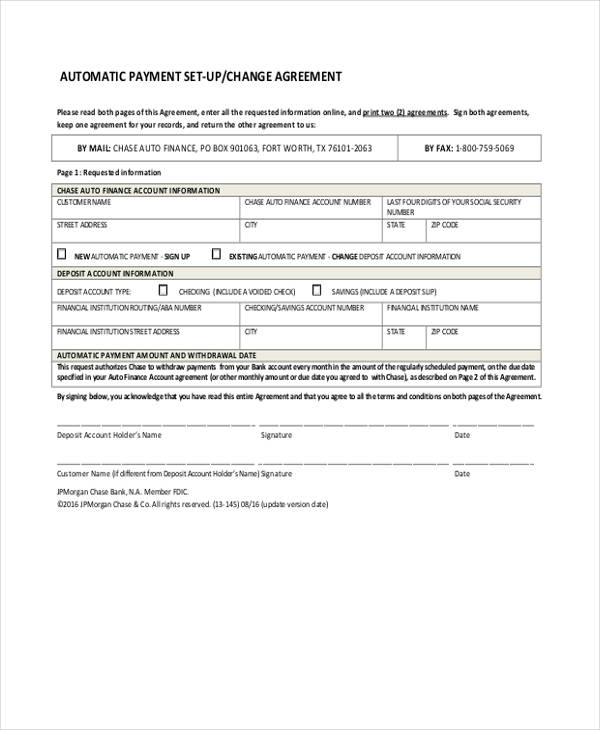

Free 43 Simple Agreement Forms In Pdf Ms Word

Free Offer Onestop Financial Solutions